Typically, AAII looks at the weighted relative strength over the trailing four quarters. Momentum is based on the price change of a stock over a specified period relative to all other stocks. Momentum grades help uncover stocks experiencing anomalously high rates of return research finds that stocks with high relative levels of momentum tend to outperform, whereas those with low levels of momentum tend to continue underperforming.

#FLUENT TINC FREE#

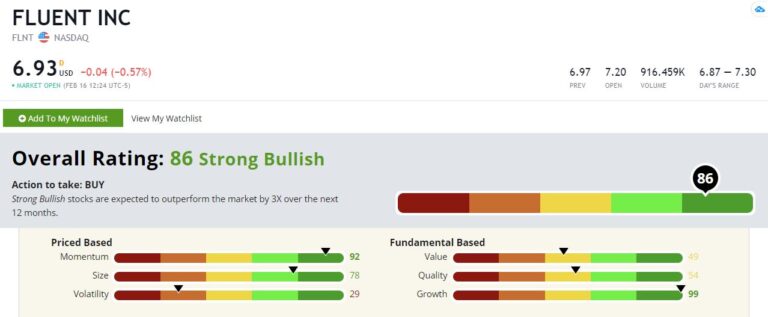

The companies in the bottom 20% of the stock universe receive Growth Grades of F, considered very weak, while those in the top 20% receive A grades, which are considered very strong.įluent Inc has a Growth Score of 94, which is Very Strong.ĭon’t Miss Your Free Report — Sign Up Here! These three rank figures are added together, and the sum is ranked against the entire stock universe to arrive at a company’s Growth Score to create an equal distribution of grades. In order to compute the Growth Score and assign it a letter grade, the percentile ranks for each of the three individual components—consistency of annual sales growth, five-year sales growth rankings adjusted for extreme levels, and consistency of positive annual cash from operations—must be determined. The foundation of growth investing is seeking out stocks of companies exhibiting strong, consistent and prolonged growth that is expected to continue into the future. Stocks with a Value Score from 81 to 100 are considered deep value, those with a score between 61 and 80 are a good value and so on.įluent Inc has a Value Score of 83, which is Deep Value.Ĭash from Operations Ann'l Positive Last 5 yrs To be assigned a Value Score, stocks must have a valid (non-null) ratio and corresponding ranking for at least two of the six valuation ratios. The score is variable, meaning it can consider all six ratios or, should any of the six ratios not be valid, the remaining ratios that are valid. The value score is the percentile rank of the average of the percentile ranks of the price-to-sales ratio, price-earnings ratio, enterprise-value-to-EBITDA (EV/EBITDA) ratio, shareholder yield, price-to-book-value ratio and price-to-free-cash-flow ratio. To decide if Fluent Inc stock is a buy or sell, you’ll want to evaluate its fair market price or intrinsic value.īuying stocks that are going to go up typically means buying stocks that are undervalued in the first place, although momentum investors may argue that point.ĪAII’s A+ Investor Value Grade is derived from a stock’s value score. Successful stock investing involves buying low and selling high, so stock valuation is an important consideration for stock selection. Sign Up to Receive a Free Special Report That Shows How A+ Investor Grades Can Help You Make Investment Decisions In 2020, the S&P Advertising subindustry Index fell 11.5% versus a 15.8% increase for the S&P Composite 1500 Index. Despite the decline in traditional ratings, television advertising will likely continue to garner the bulk of the overall spending, thanks in part to marketers looking for mass audiences. With growing share of advertising spending shifting toward the internet and other digital platforms. This provides potential for a revenue shortfall in the U.S.

(and global) economic recession and some likely pullback of discretionary spending by several marketers. However, global economic outlook has been significantly hampered by the global pandemic, precipitating a U.S. There are growth prospects, supported by exposure to emerging market consumers and enhanced digital capabilities on new advertising technologies for data and analytics. The outlook for the advertising subindustry is neutral. Fluent Inc does not currently pay a dividend. Analysts expect adjusted earnings to reach $-0.350 per share for the current fiscal year. Year-over-year quarterly sales growth most recently was -13.2%. Fluent Inc’s trailing 12-month revenue is $349.3 million with a -43.9% profit margin. Read on to find out how ( FLNT) grades on certain investment factors and determine whether it meets your investment needs.Īs of June 15, 2023, Fluent Inc had a $55.3 million market capitalization, putting it in the 28th percentile of companies in the Advertising & Marketing industry.įluent Inc does not have a meaningful P/E due to negative earnings over the last 12 trailing months. Learn more about whether Fluent Inc is a good stock to buy or sell based on recent news as well as its key financial metrics.

0 kommentar(er)

0 kommentar(er)